Market Segments: Cybersecurity, Network Monitoring, and Cloud Services

As a specialist IT integrator, Passus works with a portfolio of advanced technologies in cybersecurity and network performance monitoring. The company is a key integration partner for vendors like Splunk, Riverbed, and ManageEngine. In fact, Splunk (a leading cybersecurity and analytics platform) is one of Passus's top revenue drivers, with Passus being one of only three official Splunk partners in Poland. This is reflection of Passus's role in delivering complex security information and event management (SIEM) and network monitoring solutions to large clients.

As a specialist IT integrator, Passus works with a portfolio of advanced technologies in cybersecurity and network performance monitoring. The company is a key integration partner for vendors like Splunk, Riverbed, and ManageEngine. In fact, Splunk (a leading cybersecurity and analytics platform) is one of Passus's top revenue drivers, with Passus being one of only three official Splunk partners in Poland. This is reflection of Passus's role in delivering complex security information and event management (SIEM) and network monitoring solutions to large clients.

Another core area is cloud computing services. Passus's group includes Chaos Gears, a unit specializing in AWS cloud projects - from migrating client systems to the cloud to ongoing infrastructure management and maintenance. In the AWS Services segment, the company executes cloud migrations, cloud security setups, and AI/data engineering projects for clients both in Poland and abroad. Notably, Chaos Gears is working toward achieving AWS Premier Consulting Partner status by 2026, a certificate that could further elevate Passus's profile and help drive international expansion in Western Europe and Central & Eastern Europe. This focus on cloud services, combined with expertise in cybersecurity and monitoring, gives Passus a multi-faceted presence in the IT solutions market.

Customer Base: Enterprise and Public Sector Focus

Passus's customer base skews toward large organizations, spanning both private enterprises and government institutions. The company explicitly concentrates on serving big corporate clients and public-sector entities in Poland (and to some extent abroad). A significant portion of its business comes from public procurement projects - in 2024, about 65% of the group's revenues were generated from contracts with public-sector clients. These often involve competitive tenders where price and quality are key factors in winning contracts (typically weighted 60% price and 40% quality and service criteria in Polish public tenders). This emphasis on government and quasi-government projects means Passus benefits from public investment in cybersecurity and IT upgrades, which remains robust. As CEO Bartosz Dzirba noted, public-sector demand for cybersecurity is fueled by ongoing threats (from hackers or even state actors) and continuous funding at national and EU levels to counter those threats

At the same time, Passus is aiming to grow its enterprise (commercial) client segment. The company has indicated that while public-sector projects dominate, they are working to secure at least one new large multi-year private or public client contract each year to diversify growth. Importantly, management also stresses that revenue is not overly dependent on any single contract. The majority of revenues from the public sector is spread across a range of projects rather than stemming from one or two deals. This suggests a customer base strategy of broadening engagements so that no single project's outcome can dramatically sway overall performance.

Financial Performance: First Half 2025 Highlights

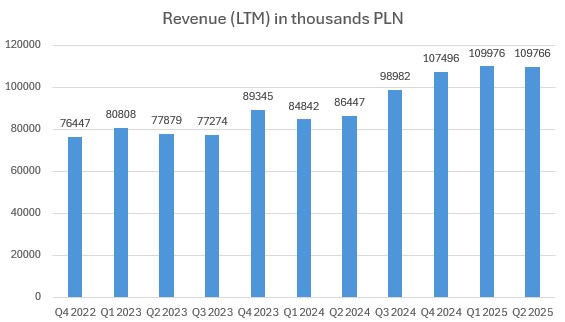

Revenue Growth: Passus reported solid top-line growth in the first half of 2025. Consolidated sales for H1 2025 reached PLN 26.1 million, up about 12.6% year-over-year from approximately PLN 23.2 million in H1 2024. This double-digit revenue increase reflects healthy demand across the company's segments. In particular, the AWS cloud services division showed a notable rebound - the AWS segment contributed roughly PLN 7.9 million in sales in H1 2025 (around 30% of total revenue), compared to about PLN 6.1 million in the same period a year prior. This ~29% jump in cloud-services revenue suggests that the earlier slowdown in cloud projects (which impacted 2024) has started to reverse. In last twelve months terms, revenues in Q2 2025 increased 27% to PLN 109.8 MLN.

Source: Passus S.A. finanical statements inwestor.passus.com

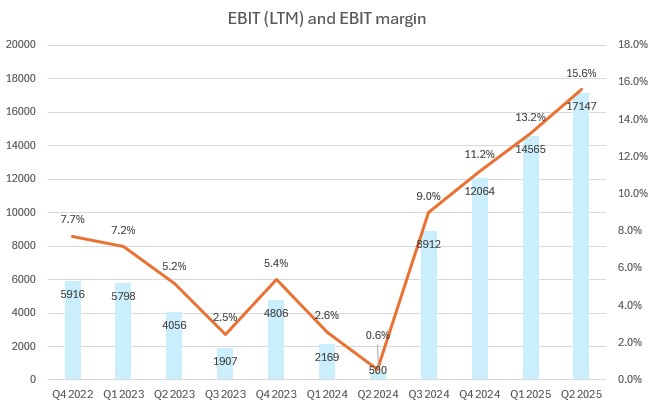

Earnings and Margins: Profitability improved markedly in 2025's first half, although absolute profit levels remain modest. The group essentially broke even at the EBITDA level in H1 2025, posting an EBITDA of approximately PLN 0.1 million. While an EBITDA near zero might seem low, it is a significant improvement from the same period of 2024 when Passus had a negative EBITDA (an EBITDA loss of over PLN 2 million). The turnaround was driven by higher revenue and cost controls - for example, operating loss narrowed to PLN -0.84 million in H1 2025 from a PLN -3.23 million operating loss a year earlier. Net loss for the half was also reduced to PLN -0.84 million, about half the loss of the prior-year period. EBIT margins have improved as well. In H1 2025, the EBIT margin was 15.6%, compared to only 0.6% at the end of H1 2024.

Source: Passus S.A. finanical statements inwestor.passus.com

It's worth noting that Passus's business is highly seasonal (not visibly on above chart due LTM metrics), with the bulk of its annual sales and profits historically coming in the second half of the year (especially Q4). Management confirms that the fourth quarter is typically key - the company often realizes over half of its full-year revenue (and the majority of its profit margins) in Q4 alone. This seasonality is tied to client budgeting cycles, particularly in the public sector where many projects get finalized late in the year. Consequently, first-half results tend to be much weaker than second-half, and a near-breakeven H1 is not unexpected for Passus. The company's improving first-half margins, however, suggest an upside if second-half projects continue to ramp up as usual.

Operational Model: People-Centric and Asset-Light

One distinguishing aspect of Passus's model is its operational focus on human capital over physical capital. The company does not require heavy capital expenditures in manufacturing or equipment - instead, it invests in developing the skills and expertise of its engineering teams. Management has stated that the group essentially “does not invest in CAPEX, only in talent development,” reflecting an asset-light approach where growth is driven by intellectual property and know-how rather than owning physical infrastructure. This means that a significant portion of expenses is staff-related (engineers, consultants, certifications, etc.), and success hinges on attracting and retaining highly qualified IT specialists.

Passus appears to manage talent strategically. For example, the company recruits young engineers straight out of university (or even during studies) and relies on employee referral programs, which helps mitigate wage costs to some extent. By building a pipeline of skilled professionals early in their careers and fostering loyalty (through referral incentives and a motivational stock program), Passus can partially contain the wage pressure that is common in the IT industry. The business model also implies scalability through expertise - to take on more projects, Passus can grow headcount or acquire niche teams, rather than needing to build or buy expensive machinery. In fact, management has hinted at pursuing growth via acquisitions of specialized firms or teams to broaden competencies, underlining that “many possibilities” are being considered for expansion of skillsets and offerings.

Another benefit of this model is relatively low maintenance costs and depreciation, which supports healthier margins once revenues scale. With less capital tied up in fixed assets, Passus can potentially convert a higher portion of gross profit into operating profit, assuming personnel utilization remains high. The company's target profitability reflects this - management is aiming for an EBITDA margin of at least 10%, a goal they describe as conservative and not overly ambitious. In 2024, Passus actually achieved an EBITDA of PLN 14.1 million on PLN 107.5 million revenue, which was roughly a 13% EBITDA margin, suggesting that the 10% margin target is indeed attainable barring any downturn. This operational leverage - low capex and high-skilled labor - means that once fixed overhead and staff costs are covered, additional revenues can significantly boost earnings.

Growth Opportunities and Outlook

Despite a challenging macro environment in recent years, Passus's strategic plan outlines robust growth ahead. The company is projecting around 15% average annual revenue growth through 2026, as reaffirmed by the CEO. This growth is expected to come from multiple fronts:

- Cybersecurity Demand: The continued rise of cyber threats is driving organizations to invest more in IT security and network monitoring. Passus's core expertise in these areas positions it well to capture new projects as businesses and government agencies fortify their defenses. Management notes that both Poland and the EU are allocating significant funds to cybersecurity, which bodes well for sustained demand in the public sector especially. This secular trend provides a tailwind for Passus's integrator services.

- Cloud Services Expansion: After a dip in 2024, cloud infrastructure projects are rebounding for Passus. The AWS-focused segment (Chaos Gears) has seen revenues recover, and the company is placing “particular emphasis” on expanding its cloud and generative AI offerings on AWS in 2025. Achieving higher partner status with AWS by 2026 (the goal of reaching Premier Partner level) could open doors to larger international contracts. Additionally, as more enterprises migrate to cloud and seek hybrid cloud solutions, Passus's experience in cloud migration and security should translate into new business opportunities.

- Public Sector Pipeline: The digitization of government services and the availability of EU and state funding for IT modernization provide a growth pipeline in Passus's home market. The group has a strong track record in public-sector projects and can leverage this reputation to win new tenders. Importantly, public clients often engage in multi-year frameworks for IT services. Passus aims to onboard at least one major new client (public or private) every year on a long-term engagement, which over time would accumulate into a larger recurring client base.

- Upselling and Cross-Selling: As an integrator with a broad portfolio (security, monitoring, cloud, AI), Passus can cross-sell new solutions into its existing client base. For instance, a large enterprise client initially using Passus for network performance monitoring might later adopt the company's cybersecurity solutions, or vice versa. The development of new capabilities (like data engineering and AI services) within the AWS segment provides more products to offer clients. This organic growth within accounts could contribute meaningfully to the 15% annual growth target.

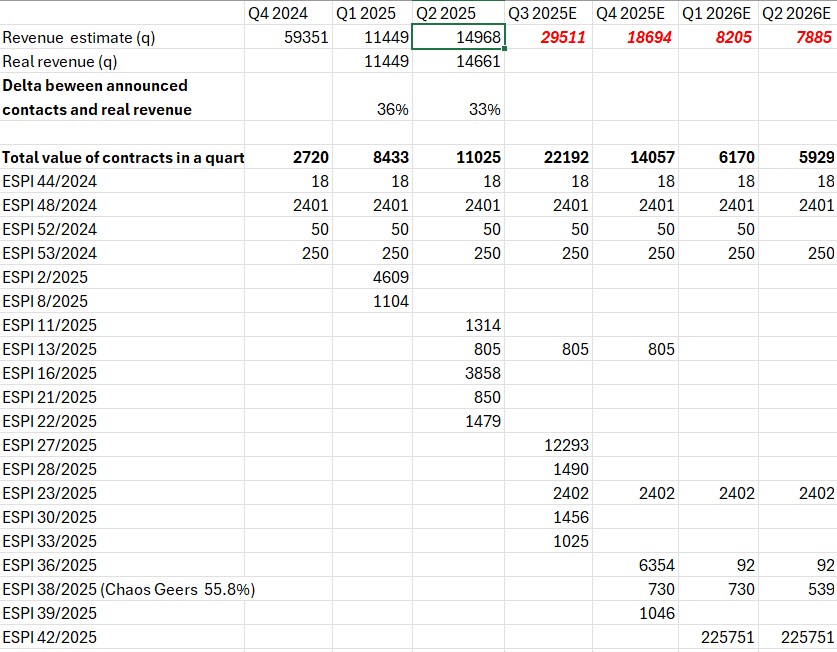

Below are revenue estimates for upcoming quarters based on communicated and signed contracted which company shared on ESPI platform. The real revenue is typically 33-36% higher than sum of signed contract, because revenue allocation difference also due to the fact that company doesn't need to communicate contacts smaller than PLN 1 MLN.

Source: Passus S.A. ESPI reports on biznes.pap.pl

Please be aware that above estimates are created using best-effort revenue allocation based on Passus's announcement. Assuming no revenue from communications (33%), the company should achieve approximately 29.5 million in Q3 (a 21.3% YoY increase).

Overall, Passus's growth outlook appears positive. The company delivered ~19% revenue growth in 2024 and started 2025 on a strong note (even noting a 34% surge in Q1 2025 revenue year-on-year). While the first half of 2025 was relatively soft in earnings due to normal seasonality, the second half - especially Q4 - is expected to drive the bulk of annual results. If Passus can maintain momentum in winning new contracts and capitalize on the favorable market trends in cybersecurity and cloud, its 15% CAGR goal through 2026 seems within reach.

Risks and Challenges

Like any growing tech-focused company, Passus faces several risks and challenges that investors should keep in mind:

- Wage Pressure and Talent Retention: The shortage of skilled IT engineers means rising salaries industry-wide. Passus feels this wage pressure and must continue to attract and retain top talent without eroding its margins. Competition for experts (especially in cybersecurity and cloud architecture) could increase personnel costs. The company mitigates this by hiring young talent and via referrals, but sustaining a high-quality team in a hot labor market remains an ongoing challenge.

- Seasonality of Revenues: Passus's business is inherently seasonal, heavily weighted toward the end of the year. A large portion of sales (often over 50% of annual revenue and the majority of profit) is realized in the fourth quarter. This means interim results can fluctuate significantly. Any delays in project awards or customer budget shifts into the next year could leave first-half results underwhelming. The company acknowledges that Q1-Q2 revenues are much lower than Q4, which affects interim profitability. Investors must be prepared for uneven quarterly performance and focus on full-year outcomes.

- Project-Based, Large Contracts Dependency: The nature of Passus's work is mostly project-based, rather than recurring subscription revenue. The company's income depends on securing new contracts (often large, bespoke projects) and successfully delivering them. A delay or loss of a single major contract in a given year can create a shortfall that isn't easily compensated by smaller deals. While Passus has a broad mix of projects at any time, the lumpiness of project revenues is a risk - some periods may see very low revenue if few contracts are billable. This also can impact cash flow timing, as big projects might involve delayed payments or milestone billing. The risk is partly mitigated by the company's effort to convert more clients to multi-year engagements and support contracts (which provide more predictable income), but dependency on winning new big projects each year remains a fundamental aspect of the business.

- Competitive and Tender Environment:In the public sector, contracts are awarded largely on a competitive tender basis with strict evaluation criteria. There is always a risk that Passus could be underbid on price or outscored on technical criteria by a competitor in key bids. The need to remain price-competitive (when 60% of tender points may come down to price) could pressure margins or growth if market pricing becomes aggressive. Additionally, larger international IT firms might try to move into the Polish market or cloud niche, posing longer-term competitive threats. Passus's niche expertise and local experience are advantages here, but the company must continuously prove its value to win contracts against both local and global competitors.

- Macroeconomic and Budget Factors: Broader economic conditions and public budget cycles can influence Passus's performance. For instance, if government IT spending were to tighten (due to economic downturn or shifting priorities), Passus's public sector-heavy revenue could be impacted. Inflation also plays a role - high inflation can increase costs (wages, operating expenses) and also drive up the value of contracts, but if not matched with pricing power, could squeeze profitability. On the positive side, EU funding availability for digital projects is a factor that could either bolster or, if absent, constrain some opportunities. The company does note, however, that it is not reliant on any single external subsidy program (for example, it “does not depend on KPO funds”, referring to Poland's recovery plan funds), implying it has a diversified customer funding base.

Conclusion

In summary, Passus S.A. presents itself as a nimble IT integrator with strong domain expertise in cybersecurity, network monitoring, and cloud services. The company operates a scalable, human-capital-intensive model that has begun to translate into improved financial performance. With a return to growth in its cloud segment and steady demand for security solutions, Passus is targeting an ambitious ~15% annual revenue growth through 2026 while striving to maintain double-digit EBITDA margins. The firm's focus on large enterprise and government clients has proven fruitful, leveraging Poland's digital security drive and public IT spending, although it also brings concentration risks and seasonality.

For retail investors interested in micro-caps, Passus offers exposure to the cybersecurity and cloud infrastructure trends via a company that is still relatively small-cap but growing. Key things to watch will be how well Passus converts its pipeline into new contracts (especially in the competitive public sector) and whether it can sustain profitability improvements towards its margin goals. Additionally, management's execution in retaining talent and possibly expanding through acquisitions will factor into its growth trajectory. While challenges such as wage inflation and lumpy revenues exist, Passus's recent track record, including a nearly 20% sales jump in 2024 and improved first-half 2025 results, indicates resilience. If the company delivers on its strategic plans, it could continue to benefit from the robust demand for cybersecurity and cloud services in the years ahead, making it an intriguing story in the tech-oriented segment of the Polish market. We recommend you following company announcements on our web site in Company News Hub section.