Market Segments: Funeral and Burial Services

Source: Grupa Klepsydra S.A. investor relations materials Grupa Klepsydra S.A. is a holding company. The revenue are generated through its subsidiaries, which operate in several key segments:

- 1. Comprehensive Funeral Services: Organizing burials (traditional and urns). In the first three quarters of 2025, the group performed 3,624 burials, a 54% increase year-on-year.

- 2. Cremation Services: Operating crematoriums. The group performed 6,798 cremations in the first three quarters of 2025 (however significant part of them is performed for external funeral companies. Revenue for Klepsydra would PLN1-2k from such ceremony).

- 3. International Transport: Through its subsidiary Bongo, the group specializes in the cross-border transport of the deceased and ashes, a niche where it holds a significant market position.

- 4. Cemetery Management: The subsidiary Centrum Pogrzebowe manages the cemetery in Podgórki Tynieckie (Kraków) under a Public-Private Partnership (PPP) contract valid until 2044.

- 5. New Technologies: Generating revenue through eKlepsydra, a digital notification service for funeral ceremonie.

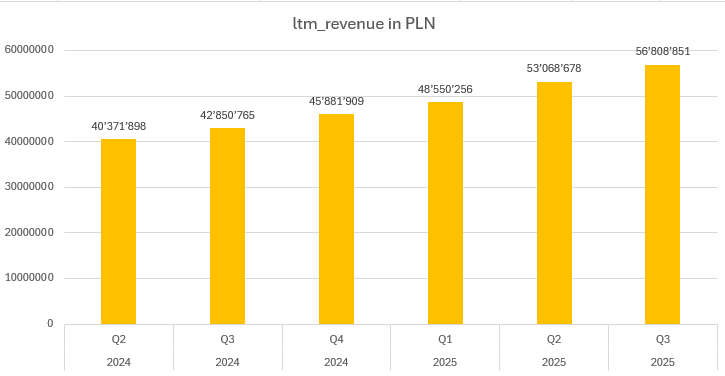

The company revenues are steadily growing. 25% in last quarter year-over-year, thanks to full consolidation of acquired in 2024 businesses.

The company is serial acquirer. It mainly finances acquisition from retained earnings. The company aims to posses 10% of Polish market in 2028 (currently ~3.4%).

10% of Polish Markets means 40k burial services in year. During recent acquisitions they paid around PLN 5920 for single burial services (two companies acquired in 2024 for total of PLN 9.2MLN, these companies performed 1554 burial services in 2023).

Assuming Grupa Klepsydra performs around 6000 full burial services a year, they need to “purchase” through acquisitions 34000 burial services. If they paid same PLN 5920 for burial service acquisition, they would need to invest ~PLN 201MLN. The company generated PLN 11.4PLN cash from operating activities. It is clearly sufficient to fund all the necessary acquisitions till 2028. However company claims that acquisitions will be bring synergies and costs reductions (more on that later).

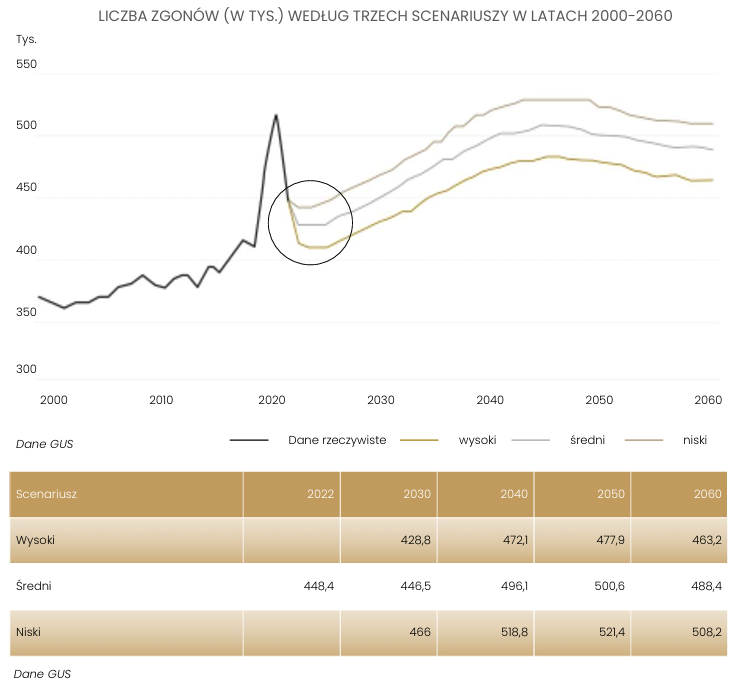

There is little organic growth, but after post-pandemic decrease there is now stabilization with slow increase in number of deaths. Over the next few years, due to demographic changes in Poland country, the number of deaths could systematically increase. According to forecasts by the Central Statistical Office (GUS), the increase in the number of deaths will be steady and may exceed 500,000 in 2046 (in 2024 there were 403,167 deaths), it means 0.93% deaths count CAGR.

Source: Grupa Klepsydra S.A. investor relations materials

On a positive note, the revenue from single burial services could increase because starting from 2026 Polish government increased funeral allowance from PLN 4,000 to PLN 7,000.

I analysed whether acquisitions have the promised impact on business efficiency as claimed by management, and whether there are visible synergy effects. Based on my analysis, I cannot confirm this thesis.

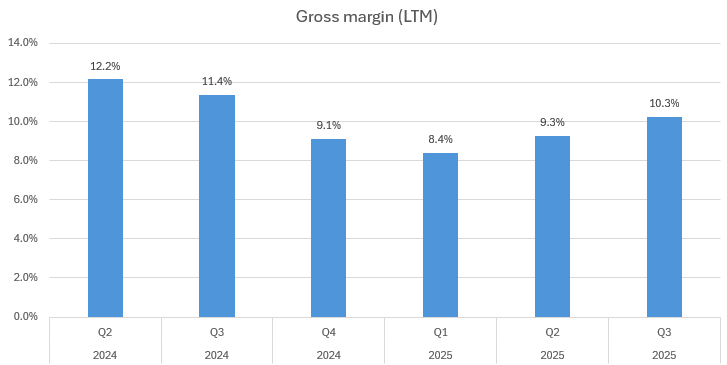

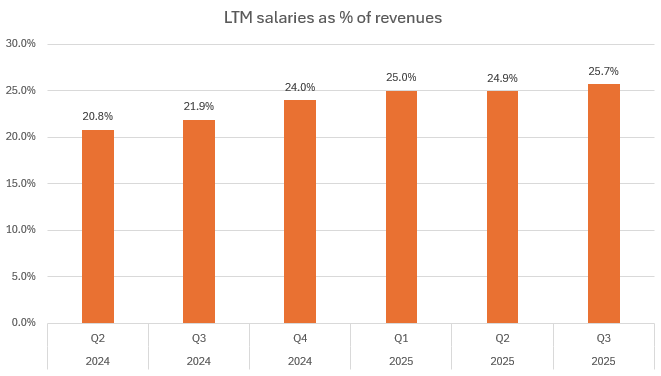

As metrics intended to reveal synergy effects, I used ratios which compare operating costs to revenue:

- gross margin (LTM)

- salaries costs as a percentage of revenue

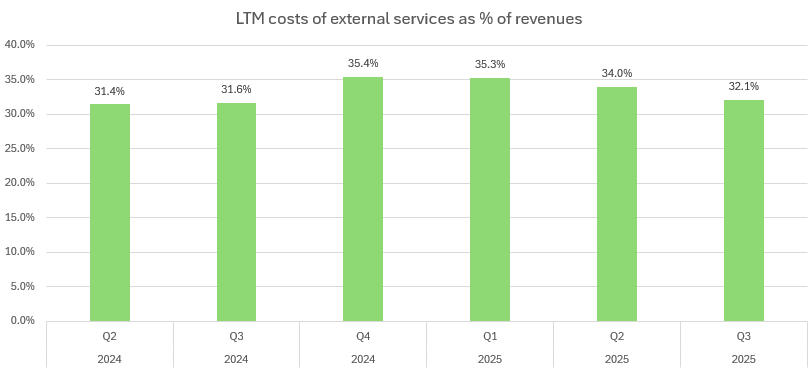

- external service costs as a percentage of revenue

As seen in the charts, the gross margin shows a rather downward trend, and personnel costs are increasing. Only in the area of external services has there been a slightly positive trend over the last two quarters.

So for now, it looks more like capital allocation aimed at expanding the business, but it's hard to identify any clear synergy effects.

As seen in the charts, the gross margin shows a rather downward trend, and personnel costs are increasing. Only in the area of external services has there been a slightly positive trend over the last two quarters.

So for now, it looks more like capital allocation aimed at expanding the business, but it's hard to identify any clear synergy effects.

Regarding return on invested capital, the adjusted "cash" ROIC is about ~8.7% excluding non-cash goodwill amortization. (Adjusted NOPAT: PLN 7.5mln, invested capital: PLN: 86.7MLN). Current P/E is very high: 27.6. However, earnings are depressed by significant amortization of acquired businesses. Other ratings, which in my opinion better reflect company’s valuation are:

- P/CFO is 16.4.

- EV/EBITDA: 17.

Conclusion

This is a predictable, easy-to-analyze business with low “black swan” risk, which I find appealing. That said, the current valuation does not justify a purchase.