Company's Overview

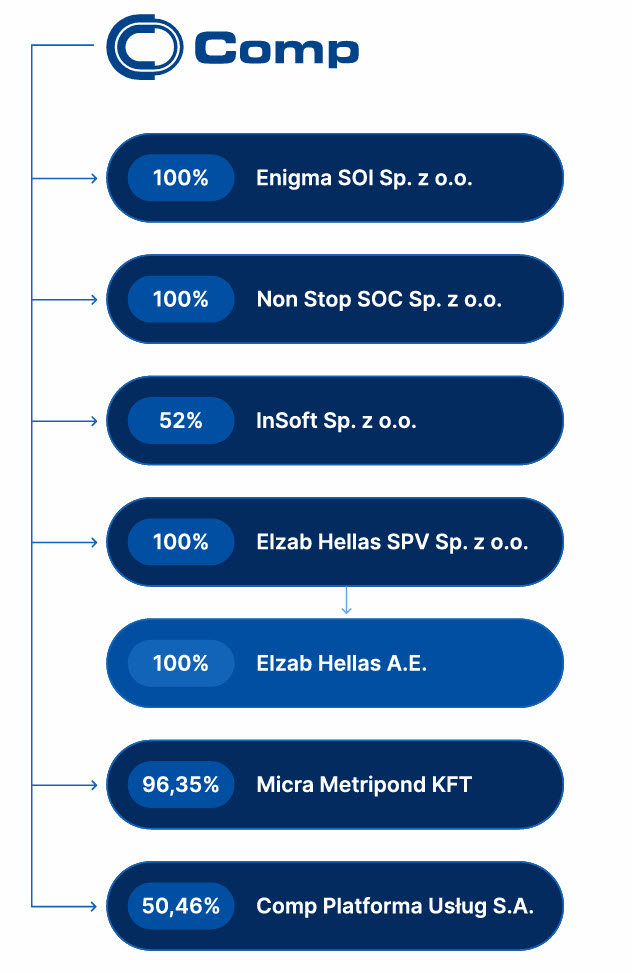

Comp S.A. (WSE: CMP) is a Polish IT integrator (founded 1990; listed on WSE since 2005 in sWIG80). It heads a capital group with well-known brands: Enigma (specialized security/cryptography), NonStop SOC (cybersecurity support), Elzab (multi-functional fiscal cash registers), and Insoft (retail POS software). The Group focuses on digital security systems and retail management solutions; it is a leading Polish supplier of secure IT systems for defence, government and large enterprises.

Business Model & Revenue Generation

Comp makes money by selling hardware and services in two main segments:

IT Security/Integration segment

Comp offers cybersecurity products (cryptography modules, SOC monitoring), network design and integration, data-center and cloud services, plus maintenance contracts.

Electronic Monitoring Systems

Electronic Monitoring Systems (in Polish, System Dozoru Elektronicznego, or SDE) enable authorities to supervise individuals under house arrest or other community-based sanctions via wearable devices and a supporting software platform Comp S.A. is actively involved in the SDE (System Dozoru Elektronicznego - Electronic Monitoring System) sector through its fully owned subsidiary Enigma Systemy Ochrony Informacji Sp. z o.o.

Key Highlights:- Technology and Exports - Enigma delivers both hardware and proprietary software for SDE systems, allowing the company to participate in export contracts. International implementations typically involve partnerships with local companies.

- Current International Projects:

Armenia: In 2023, Enigma won an expansion contract for an existing SDE project, delivering 1,000 new sets for monitoring detainees (approx. EUR 1.5 million).

Czech Republic: A new SDE project is under design phase, with the main implementation scheduled for 2024 (approx. EUR 2.5 million).

- Domestic Activities:

In Poland, the system is mature and the company is currently delivering ongoing maintenance and upgrades, generating annual revenues of over PLN 20 million.

A fifth generation of the SDE system in Poland is scheduled for mid-2027, marking a new upgrade cycle.

- Strategic Importance: SDE is considered a strategic growth area within Comp's broader IT and security portfolio.

Cybersecurity

The execution of these solutions is handled primarily by Enigma Systemy Ochrony Informacji Sp. z o.o., a 100% owned subsidiary. Comp S.A. provides classified and unclassified security and IT solutions to the Ministry of National Defence (Ministerstwo Obrony Narodowej - MON), with a particular focus on:

- Cryptographic Devices and Secure Communications: The company (via its Enigma subsidiary) produces and develops cryptographic devices used for securing classified communications. These are supplied to military and other government entities that process confidential data.

- Classified IT Projects: Comp has won several tenders for MON. Notably, it is delivered a large classified project started in 2022. The project is continuing in 2025.

The NonStop SOC (Security Operations Center) is a cybersecurity-focused fully owned subsidiary of Comp S.A. This entity specializes in continuous security monitoring, incident response, and threat intelligence services, delivering:

- Managed security services, including 24/7 monitoring of IT infrastructure

- Detection and response to cyber threats

- Integration of security technologies, possibly including tools from global vendors and Comp's proprietary products

In Q1 2025, the company was still in its development phase, posting minor revenues (PLN 78k) and a net loss of PLN 67k.

Retail segment

The Retail segment of Comp S.A. focuses on developing and manufacturing online fiscal cash registers, which are essential for tax-compliant sales recording in Poland. Additionally, it offers SaaS (Software as a Service) and VAS (Value-Added Services), supporting retailers with digital tools for transaction processing, data analytics, and integration with marketing and loyalty systems. This segment benefits from regulatory changes requiring fiscalization across various sectors. Retail segment consists of following components

Fiscal cash registers

Fiscal cash registers are certified devices used to record sales and taxes in compliance with Polish fiscal regulations, playing a central role in Comp S.A.'s Retail segment. Between 2019 and 2024, they sold 1.4 million fiscal cash registers, with the peak in 2021. In recent years, annual sales have been around 200,000 units. Since these devices are typically replaced every 6-7 years, an increase in sales can be expected in 2027-2028. For example, currently, fiscal cash registers are being replaced by fuel stations such as Orlen (around 10,000 units), as well as Mol and Lotos. In 2028-2029, fiscal cash registers will be replaced by doctors, beauticians, and other service providers. Every new sector that becomes subject to fiscalization has a positive impact on the company's results. For example, in 2027, fiscalization requirements for parking lots and vending machines will come into force, which means the sale of several tens of thousands of devices.

M/platform

The M/platform in Comp S.A.'s portfolio is a proprietary retail technology and services ecosystem designed to serve retail chains and independent stores. It provides a SaaS-based subscription model for delivering value-added services (VAS) such as:

- Loyalty programs

- Electronic receipts (e-paragons)

- Payment services

- Sales analytics

- DRS (deposit return system) software for managing bottle deposit refunds

- Integration with multifunctional fiscal devices

It operates on tens of thousands of installed devices, and the model is heavily based on recurring subscription income. As of early 2024, over 70,000 devices in Poland were running M/platform services nearly double the number from a year prior.

Key highlights:- The entire subscription revenue backlog for 2024-2027 has been contractually secured and rose to over 90 million PLN, not including potential variable revenues.

- The largest partner is Eurocash.

- Services are provided via Comp Platforma Usług S.A., a partially owned subsidiary.

- Comp has discontinued less promising international activities, especially those linked to a previous model for developing M/platform abroad. This led to a one-time 69 million PLN impairment in 2023 tied to goodwill from the 2014 acquisition of JNJ Ltd.

- The company has now narrowed its strategy to grow M/platform only in partnership with large retail operators with nationwide scale and logistics infrastructure.

The new model is designed to improve margins, reduce working capital needs, and enhance predictability of earnings. The company targets for 2024 was 45-48 million PLN in M/platform-related subscription revenues and around 25 million PLN in EBITDA from this segment. However, company did not report on actual results.

Click here to download the full analysis of Comp S.A.